Engagement through Earnings.

We consistently heard in interviews that agents believed they earned less on Airtel compared to other mobile money providers, which makes them less committed to serving Airtel customers. Commission transparency is key for MNOs to shake off myths surrounding earnings as an agent. We think that this transparency and predictability around their earnings will make agents feel like they’re earning more.

-

“Agents in our area don’t think they earn anything with Airtel, so they send customers our way instead.” —Paul & Faustine

-

“Commissions are like the lottery—you don’t know what you’re going to get!” —Khamis

Foster customer confidence over time.

Initial research on transaction data reveals that average transaction size increases with subsequent visits to the same mobile money agent. This demonstrates the value of loyalty for the customer, agent, and MNO. Larger transactions become less risky with a familiar agent, but are also more valuable to those agents in terms of commission.

Capitalize on Agent Experience

We co-designed training material with agents, asking them about their specific methods for helping customers with certain transaction types. Agents know more than their customers about the opportunities and challenges of transactions, as part of their day-to-day activities. Agents were able to speak in detail about easy errors and the potential for fraud with different transaction types. They know about other products and services provided on different mobile money platforms, but don’t feel like it’s worth their time conveying these uncommissioned services to customers.

-

“I was using phone vouchers as a workaround for sending money to rural villages before mobile money!” —Nasri

-

“We know how to use TIMIZA, but we don’t earn anything by selling it.” —Rajab

Not all agents are created equal.

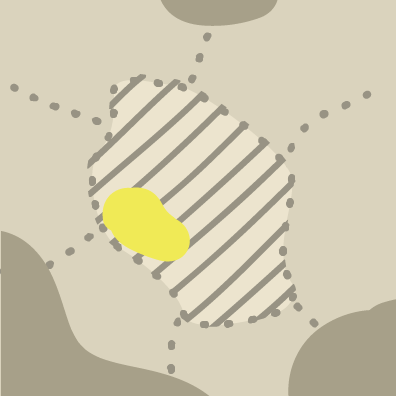

Intercepts with nearly 30 agents revealed just how varied their businesses can be. Some agents are motivated entrepreneurs and work to grow their business or build a franchise. Others operate other businesses and need to negotiate how much time is spent between different activities. They may have employees that attend their shops on their behalf, or they may do it themselves every day. To-date, agent training and support has been packaged as “one-size-fits-all.” Understanding the variance in structure and aspiration will help MNOs optimize their network.

-

“Being a wakala has given me diversity! But I still have to run my IT side business to bring in enough income.” —Christian

-

“My employees are trained on customer service for three months before they’re allowed to operate one of my shops.” —Rehima