Relating to a Story

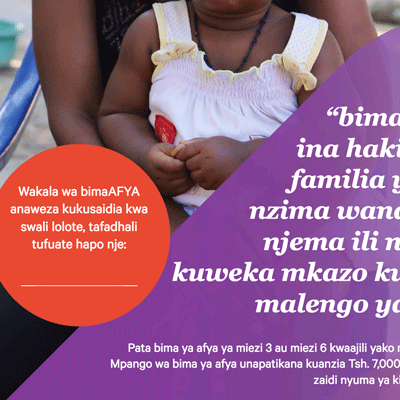

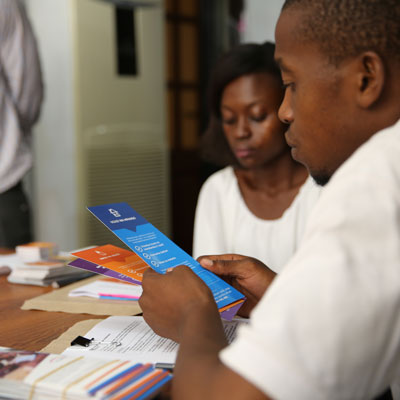

We found a common thread between everyone we talked with in Tanzania: Everyone has a story about their last hospital experience, and it’s an emotional one. Stories of walking five kilometers with a sick child on their back, or calling all their friends and family to cover expenses for a mother’s illness were raw, real, and detailed. However, none of this emotion carried over in the way health insurance was presented to customers. Instead, we observed individuals exasperated trying to read a confusing chart with too many options.

-

“I know people with health insurance are treated better at the hospital, but that is for people with a lot of money.” -- Farmer in Mbeya

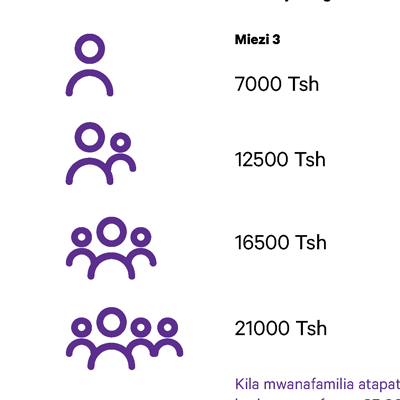

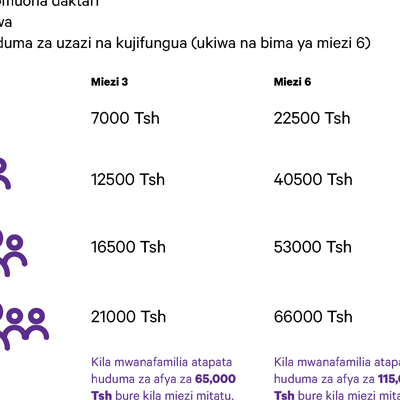

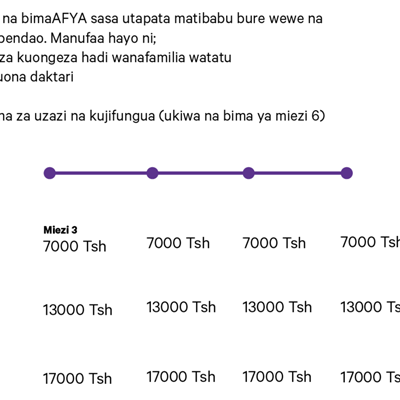

Family Plans

The Tanzanians we talked to trust and take care of their families. Households extend beyond nuclear families and often include adult siblings and older parents. Even if someone considered themselves an independent individual, at the end of the day, families take care of each other when emergency support is needed.

“I identify with the individual [insurance plan]... but if I had to buy one, it’d definitely be the family one. I have to cover my mom and dad. ”

—Market Vendor, Dar es Salaam

“I didn’t register because I needed to take care of my wife and child.”

-- Informal worker, Dar es Salaam

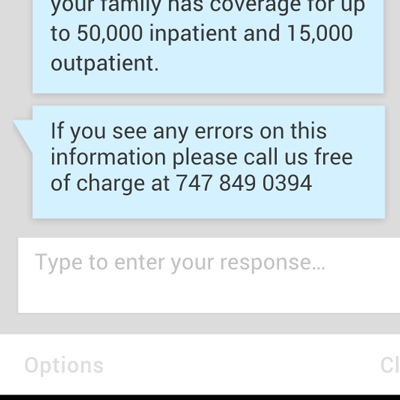

Supplying the right information

We observed that the current sales structure treated health insurance as a point-of-sales purchase. But, potential customers were approached by a group of “foot soldiers” (sales people) with no warning, and generally had no experience considering a health insurance purchase. Potential customers had lots of questions, but the foot soldiers didn’t have the personal experience to help answer them. Potential customers needed time and information to process the decision and pull together the money.

“I like it, but I need to go home and talk to my wife before I buy it.” - Potential customer, Dar es Salaam

“No, I don’t have the insurance myself. Customers always ask me if I do, but I just lie.” --bimaAFYA foot soldier

Moments of Consideration

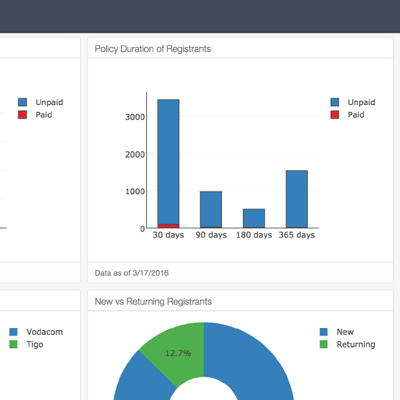

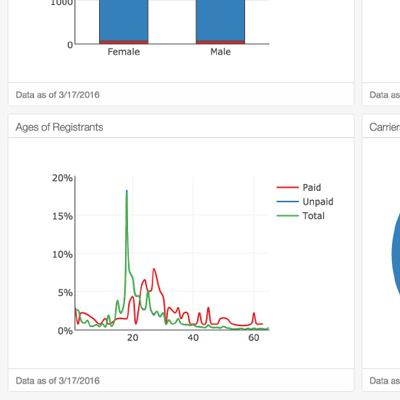

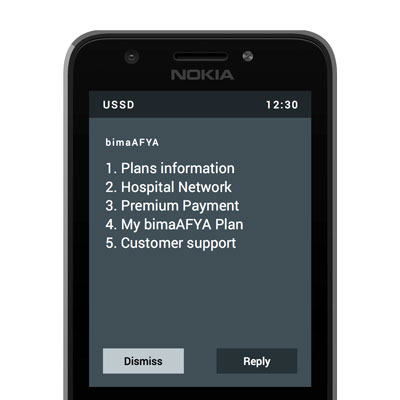

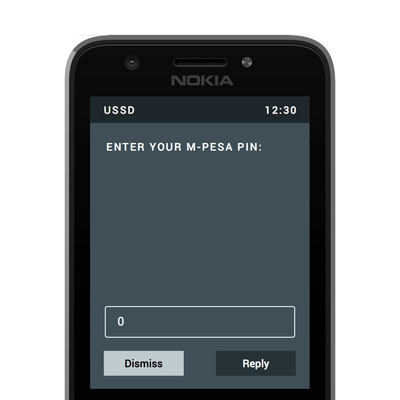

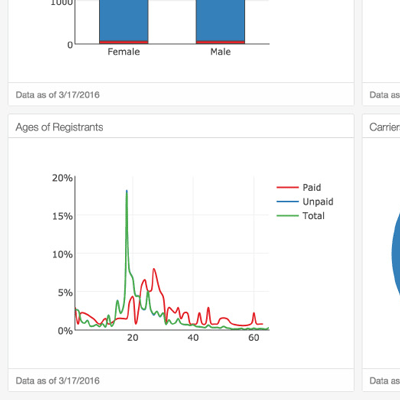

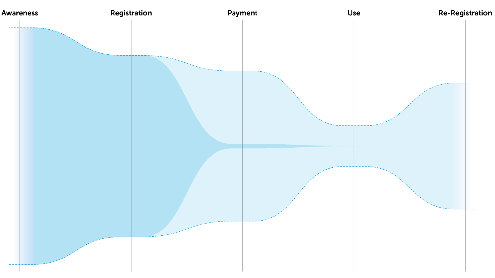

The initial launch of the bimaAFYA product saw huge dropoff between registration and payment. Our in-field observations brought to life a few difficulties in user experience: First, people were expected to pay within 24 hours, and they didn’t always have mobile money in their wallets; secondly, in order to pay, they had to exit the bimaAFYA USSD menu and move to the M-PESA menu to pay separately! We found opportunity to design around these friction points.

“I don’t have any money in my mobile account now, but could pay next week.” - bimaAFYA Potential Customer

“I like the option to pay with mobile money because that means I can buy it whenever and wherever I want.” --bimaAFYA Potential Customer