Mistakes happen.

Agents are human, and while many make transactions happen quickly, they make mistakes like everyone else. We saw an opportunity to include simple cues and reminders in the user interface to guide agents to protect themselves and prevent errors in the transaction.

-

“I once accidentally gave away all the cash before checking the amount if the funds are available” —Akram

-

“Whether customers are good or bad, you have no choice but to help them because you don’t know ahead of time.” —Sumaya

In some of our initial concepts, part of the transaction, such as inputting a PIN, was performed by customers on the agent's smartphone. This idea failed! Even though 74% of customers hand over agents their phones, agents were much more protective of their devices.

-

"I wouldn't hand over my smartphone to customers. What if they run away with it?!". —Janet

Fear is lack of information.

When it comes to trust, agents feel that their hands were tied: They worry about being victims of fraud, but also about reassuring customers they won't be a source of fraud.

-

“The books are a protection against fraud, but they are time consuming.” —Francis

-

“Today we calculate the float/cash balance at the end of the day, so we will only catch a fraud or error when it's already too late.” —Becky

We heard from many agents that they invest a lot of time balancing their books at the end of the day. It can often take an hour, sometimes two. But they don’t have much visibility into what’s happening in real time. Mistakes are bound to happen, and often then just don’t catch them in time.

-

“Today we calculate the float/cash balance at the end of the day, so we will only catch a fraud or error when it's already too late.” —Becky

Agents Need Help Too

We ran an experiment allowing a select group of agents to interact with an Airtel Customer Service Exec and ask any questions they’ve had about doing their job.

We learned that current communication channels available to agents aren’t as responsive to the agent as MNOs think they are. Agents are worried about losing business because they have to stay on the phone solving problems.

Though text-based interfaces exist, people prefer to resolve problems by talking to each other. We see this an opportunity to make a conversational UI that’s more approachable, human, and warm, and takes the pressure off the user to type a lot.

-

“I wish I had somewhere to report fraud.” —Francis

Rewarding Loyalty

We heard that many agents find ways of appreciating their loyal customers. This sometimes comes in the form of promotions or giveaways and sometimes it’s as simple as memorizing their phone numbers or pins to make transactions go quickly for their favorite customers. We also heard feedback from agents that customer book could serve as a security feature by giving agents information that could identify or flag a customer.

-

“I run promotions and giveaways for my customers to get them excited to come back to the store.” —Francis

-

“I have a book of numbers for my most loyal customers.” —Becky

-

“If a new customer comes for a big transaction, and I feel like I can't trust them, I sometimes say I don't have float and send them away.” —Doreen, focus group

Creating a Win-Win

A pain point for agents is having enough float or cash to complete a transaction. This is a variable throughout the day, and needs to be resolved quickly when it arises.

Agents know their neighbors and would be open exchanging with them if it meant getting more immediate access to float and cash at lower rates. In the beginning, we thought that they would do this to help their fellow agents, and wanted to understand how far agents were willing to go for their communities. But, we learned, it’s really a win-win. When one agent needs float, the other might need cash.

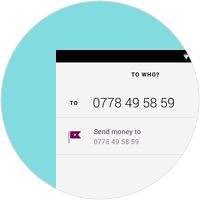

Customer Transparency

Customer Transparency

Fraud Detection

Fraud Detection

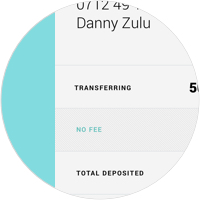

Timely Reminders

Timely Reminders

Error Detection

Error Detection